“All the bankers did was copy what everyone else did. If everyone else ran off a bloody cliff, they’d run right off a cliff with them. If there was a giant pile of gold sitting in the middle of the room and nobody was picking it up, they wouldn’t pick it up, either”

Elon Musk

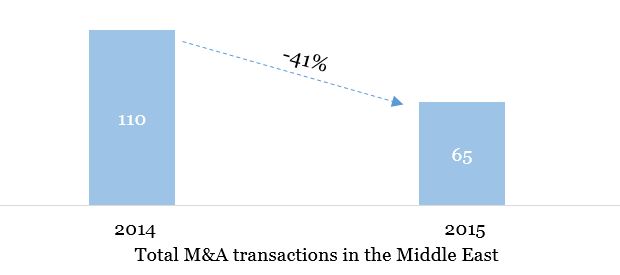

M&A activity took quite the dive in 2015, a 41% drop compared to 2014 to be specific*. You would assume the slowdown impacted all sectors relatively equally, which it did to a certain extent, but some sectors particularly stood out of the crowd. If you have been following up with the recent trends in the MENA region then you already know one of the outliers is obviously the Food and Beverage (“F&B”) sector. It is always interesting to discuss food whether it’s about recipes, new burger spots or food related M&A chit-chat.

For some reason I only connected the dots in the retail M&A market while reading Elon Musk’s biography by Ashlee Vance (highly recommended). F&B businesses were just as hot few years ago, maybe even hotter back then during a healthier market, but F&B businesses are changing hands pretty fast at the moment and 2015 was just a sign that the only investment you should go for now is F&B. So what happened recently that shifted the investors’ attention suddenly towards acquiring restaurants, cafés and basically anything that can be considered a food outlet?

The F&B Appetite Boosting Pill

We are all familiar with the herding behavior in Behavioral Finance, which is the tendency for individuals to mimic the actions (rational or irrational) of a larger group. So it only takes one trend setting transaction to resuscitate the M&A action in the F&B world, and which better trend setters than The Abraaj Group and TPG (combined “The Big Guns”)?

In early 2015, it was clear that major private equity players were after Kudu, the Saudi based fast-food chain with over 200 outlets across the Kingdom. April 2015 marked the completion of the process and The Big Guns came out as the victors with the keys to Kudu.

This coincided with Marka (Greenfield IPO which listed on the Dubai Financial Market in September 2014) acquiring Reem Al Bawadi, Marka’s first F&B acquisition. Marka is solely focused on the acquisition and expanding of anything with a store front, preferably in malls, and has already acquired several businesses in the retail industry including restaurants, accessories and apparel businesses both in the UK and the UAE.

Furthermore, and also in early 2015, it was rumored that Americana (Kuwait Food Company), the Kuwait based food giant (frozen food distribution and master franchisee of several international fast-food chains) was running a disposal process. Parties in the race also included trend setting players like KKR and CVC.

The Market’s Digestive System

The Big Guns and Marka signaled to the market that F&B is the way to go. This left many investment and PE houses with noticeable appetite for food and beverage related businesses in the region. The mimicking behavior of fellow investors made F&B businesses preferred targets in the region and what followed was basically a domino effect, plucking one restaurant after another especially the ripe ones.

Breakdown of the above chart is provided below

Breakdown of the above chart is provided below

Despite the decline in M&A activity, retail transactions surged in 2015 on the back of the F&B segment. Five F&B found new owners in 2015 compared to one in 2014.

Why F&B out of the retail menu?

If we follow through with the herding theory discussed earlier, we can conclude that investors are simply mimicking the behavior of The Big Guns and Marka to the dot. Of course there are other rationales driving investors to opt for F&B businesses including:

- Attractive margins

- Cash business

- Importance of travel and tourism in the region (Primarily the UAE)

- Flexible business and promptly responsive to market changes/demands

The list can certainly go on, but I would personally go with the herding theory to rationalize the current F&B wave. In my view the timing of events is far from coincidental.

Apparel, the runner up, also witnessed a noticeable increase in transactions in 2015 despite not having a trend setting transaction, but more like trend setting headlines. In early 2015 several news agencies reported that KKR and Fajr Capital (combined “The High Rollers”) were jointly bidding for a 25% stake in Azadea, Lebanon based fashion retailer and master franchisee of major brands including Virgin Megastore and Zara. The news seemed to suffice for investors to go for apparel businesses in the region pushing apparel transactions from none in 2014 to three in 2015. I am not sure whether The High Rollers will create the same ripple effect in apparel/fashion as did The Big Guns in F&B. Not because the investors wouldn’t want to, but because it won’t be as easy.

- Most fashion retailers in the region are master franchisees of several prominent brands run by some chunky organizations, the likes of Azadea, Chalhoub Group, Fawaz Al Hokair and Rivoli Group amongst others. These are big tickets not easily swallowed by many investors in the neighborhood.

- There aren’t so many mid-sized home-grown apparel businesses in the region to appeal to investors wanting to take-over SMEs. Home-grown fashion brands are not as easily conceived as home-grown F&B brands are. Whether some people like home-grown F&B brands or not is disputable, it boils down to taste, quality, preferences and location. However, fashion is predominantly still a western/international game and the chunky organizations have a good grip on the usual go-to apparel outlets in the region.

Who are the diners?

The acquirers of the five F&B transactions in 2015 were all financial/institutional investors. None of the F&B players decided to either integrate horizontally or vertically, or even eliminate competition via M&A. Reasons for not having strategic investors in the mix could be due to a number of factors:

- How F&B owners/operators perceive themselves. They consider themselves more like targets as opposed to investors as they want to cash out themselves.

- Strategic F&B investors (capable and willing to grow through acquisitions) are outnumbered by the investment and PE houses going for restaurants, cafés and other eateries.

- F&B owners/operators would rather grow organically, by franchising/adding more brands to their portfolio and/or expanding geographically.

- Financial investors fight harder for F&B businesses during bidding wars to grow existing F&B or retail division to reach an IPO worthy size.

Egestion

Provided that the investments are occurring relatively at the same time and assuming that these funds will expire around 2020 (assuming these players are exiting the investments in five years), then we’ll have another round of F&B M&A heat, but this time it will be in the PE secondary market. Unless the PE’s F&B division achieved critical mass to make it IPO worthy, F&B investments happening now will only end up exchanging PE hands depending on which fund needs to meet the hurdle rate and which new fund needs to make F&B investments because the fund’s description says so. F&B businesses are in play now because a lot of investors are in it to win it, but will probably go for a bargain in the near future when the investors’ appetite changes… the indisputable rule of demand and supply.

For now though, the F&B M&A market and the industry itself is doing great. I mean let’s face it, people living in Dubai eat out at least once a day (roughly) and it does not seem like it will change anytime soon given the fast lifestyle in this city. The same goes for other cities in the GCC I can assume. I gained around 15 kilos when I first moved to Dubai… Kilos can sneak up on you like F&B deals do.

Follow @fareselmasri

*These include all transactions including minority stakes, majority stakes, share buybacks and mergers sourced from Merger Market (as at 10 Jan. 2016)